What’s the difference between Medicare Part A, B, C, and D?

As you approach your 65th birthday, understanding Medicare becomes crucial for your healthcare planning. Medicare is a federal health insurance program designed for seniors and certain younger individuals with disabilities. However, with its various parts and options, Medicare can seem complex at first glance. This guide will break down the differences between Medicare Parts A, B, C, and D, helping you make informed decisions about your healthcare coverage.

Understanding Original Medicare

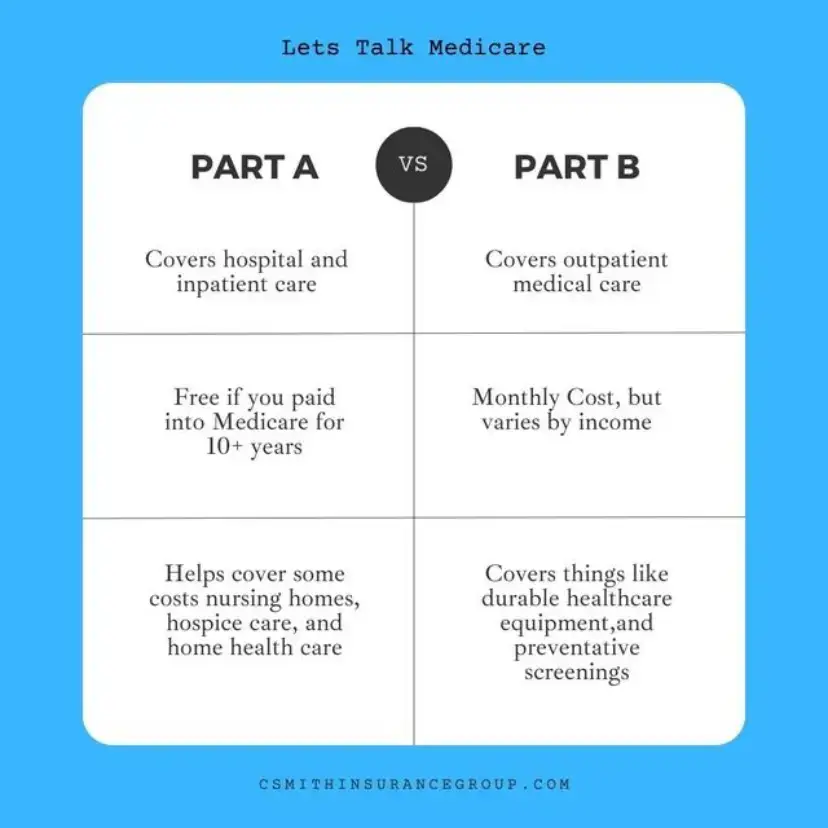

Original Medicare consists of two parts: Part A and Part B. Let’s explore each of these in detail.

Medicare Part A

What is Medicare Part A?

Medicare Part A is often referred to as hospital insurance. It’s one of the two components of Original Medicare.

Coverage details

Part A covers:

- Inpatient hospital stays

- Skilled nursing facility care

- Some home healthcare

- Hospice care

Eligibility and enrollment

Most people are eligible for premium-free Part A if they or their spouse paid Medicare taxes for at least 10 years. You’re automatically enrolled if you’re receiving Social Security benefits when you turn 65.

Costs associated with Part A

While most people don’t pay a premium for Part A, there are other costs:

- Deductible: $1,556 per benefit period (in 2022)

- Coinsurance: Varies based on length of hospital stay

Medicare Part B

What is Medicare Part B?

Medicare Part B is medical insurance, covering outpatient care and services.

Coverage details

Part B covers:

- Doctor visits

- Outpatient care

- Preventive services

- Medical supplies

- Some prescription drugs

Eligibility and enrollment

You’re eligible for Part B at 65. If you’re not automatically enrolled, you can sign up during your Initial Enrollment Period.

Costs associated with Part B

- Standard monthly premium: $174.70 (in 2024), but may be higher based on income

- Annual deductible: $240 (in 2024)

- Coinsurance: Typically 20% of Medicare-approved amount for most services

Beyond Original Medicare

In addition to Original Medicare, there are two other parts: Part C and Part D.

Medicare Part C (Medicare Advantage)

What is Medicare Advantage?

Medicare Advantage, or Part C, is an alternative to Original Medicare offered by private insurance companies approved by Medicare.

How Medicare Advantage differs from Original Medicare

Medicare Advantage plans:

- Include Part A and B coverage

- Often include prescription drug coverage (Part D)

- May offer additional benefits like dental, vision, and hearing coverage

Types of Medicare Advantage plans

Common types include:

- Health Maintenance Organization (HMO) plans

- Preferred Provider Organization (PPO) plans

- Private Fee-for-Service (PFFS) plans

- Special Needs Plans (SNPs)

Eligibility and enrollment

You can enroll in a Medicare Advantage plan if you have both Part A and Part B and live in the plan’s service area.

Costs associated with Medicare Advantage

Costs vary by plan but may include:

- Monthly premium (in addition to Part B premium)

- Deductibles, copayments, and coinsurance

- Out-of-pocket maximum

Medicare Part D (Prescription Drug Coverage)

What is Medicare Part D?

Part D provides prescription drug coverage.

Standalone Part D plans vs. MAPD plans

You can get Part D coverage through:

- A standalone Part D plan alongside Original Medicare

- A Medicare Advantage plan that includes drug coverage (MAPD)

Coverage details

Part D covers a wide range of prescription drugs, but coverage can vary by plan.

Eligibility and enrollment

You can enroll in Part D when you’re first eligible for Medicare or during the Annual Enrollment Period.

Costs associated with Part D

Costs include:

- Monthly premium

- Annual deductible

- Copayments or coinsurance

Comparing the Different Parts of Medicare

Coverage Comparison

Part A vs. Part B

Part A primarily covers inpatient care, while Part B covers outpatient services and preventive care.

Original Medicare vs. Medicare Advantage

Medicare Advantage offers all-in-one coverage, often with additional benefits, while Original Medicare provides more flexibility in choosing providers.

Prescription drug coverage options

Part D can be obtained as a standalone plan or as part of a Medicare Advantage plan (MAPD).

Cost Comparison

Premiums for each part

- Part A: Often premium-free

- Part B: Standard premium of $174.70 (2024)

- Part C: Varies by plan

- Part D: Varies by plan

Deductibles and copayments

Deductibles and copayments vary across all parts and plans.

Out-of-pocket maximums

Medicare Advantage plans have out-of-pocket maximums, while Original Medicare does not.

Flexibility and Choice

Provider networks

Original Medicare allows you to see any provider that accepts Medicare, while Medicare Advantage plans often have network restrictions.

Travel considerations

Original Medicare provides coverage throughout the U.S., while Medicare Advantage plans may have more limited coverage outside your local area.

Changing plans

You can switch plans during the Annual Enrollment Period or Special Enrollment Periods if you qualify.

Choosing the Right Medicare Coverage

Assessing Your Healthcare Needs

Consider your current health status, anticipated future needs, and prescription drug requirements when choosing your coverage.

Considering Your Budget

Evaluate monthly premium costs, anticipated out-of-pocket expenses, and long-term financial planning when selecting your Medicare coverage.

Evaluating Your Lifestyle

Think about your travel plans, preferred healthcare providers, and any additional benefits you may need, such as vision or dental coverage.

Common Combinations of Medicare Parts

Original Medicare (Part A + Part B)

Who it’s best for

This option is good for those who want flexibility in choosing providers and are willing to manage separate coverage for prescription drugs.

Pros and cons

Pros:

- Flexibility in provider choice

- No network restrictions

Cons:

- No out-of-pocket maximum

- Doesn’t cover prescription drugs

Original Medicare + Part D

This combination adds prescription drug coverage to Original Medicare.

Medicare Advantage (Part C)

Who it’s best for

Medicare Advantage is suitable for those who prefer all-in-one coverage and are comfortable with network restrictions.

Pros and cons

Pros:

- All-in-one coverage

- Often includes additional benefits

Cons:

- Network restrictions

- May have higher out-of-pocket costs for certain services

MAPD (Medicare Advantage + Part D)

What is MAPD?

MAPD plans are Medicare Advantage plans that include prescription drug coverage.

Who it’s best for

These plans are good for those who want comprehensive coverage in one plan, including prescription drugs.

Conclusion

Understanding the differences between Medicare Parts A, B, C, and D is crucial for making informed decisions about your healthcare coverage. Each part serves a specific purpose and comes with its own costs and benefits. Your choice should be based on your individual health needs, budget, and lifestyle preferences. Remember, there’s no one-size-fits-all solution when it comes to Medicare.

Next Steps

For personalized assistance in navigating your Medicare options, contact Craig Smith Insurance Group. We offer free Medicare consultations to help you find the coverage that best suits your needs. Don’t hesitate to reach out and take the next step towards securing your healthcare future.