When it comes to Medicare, there are two main types of plans: Medicare Advantage and Medicare Supplement. Both have their pros and cons, but which one is right for you? In this article, we’ll explore the differences between Medicare Advantage and Medicare Supplement plans and help you decide which is the best option for you.

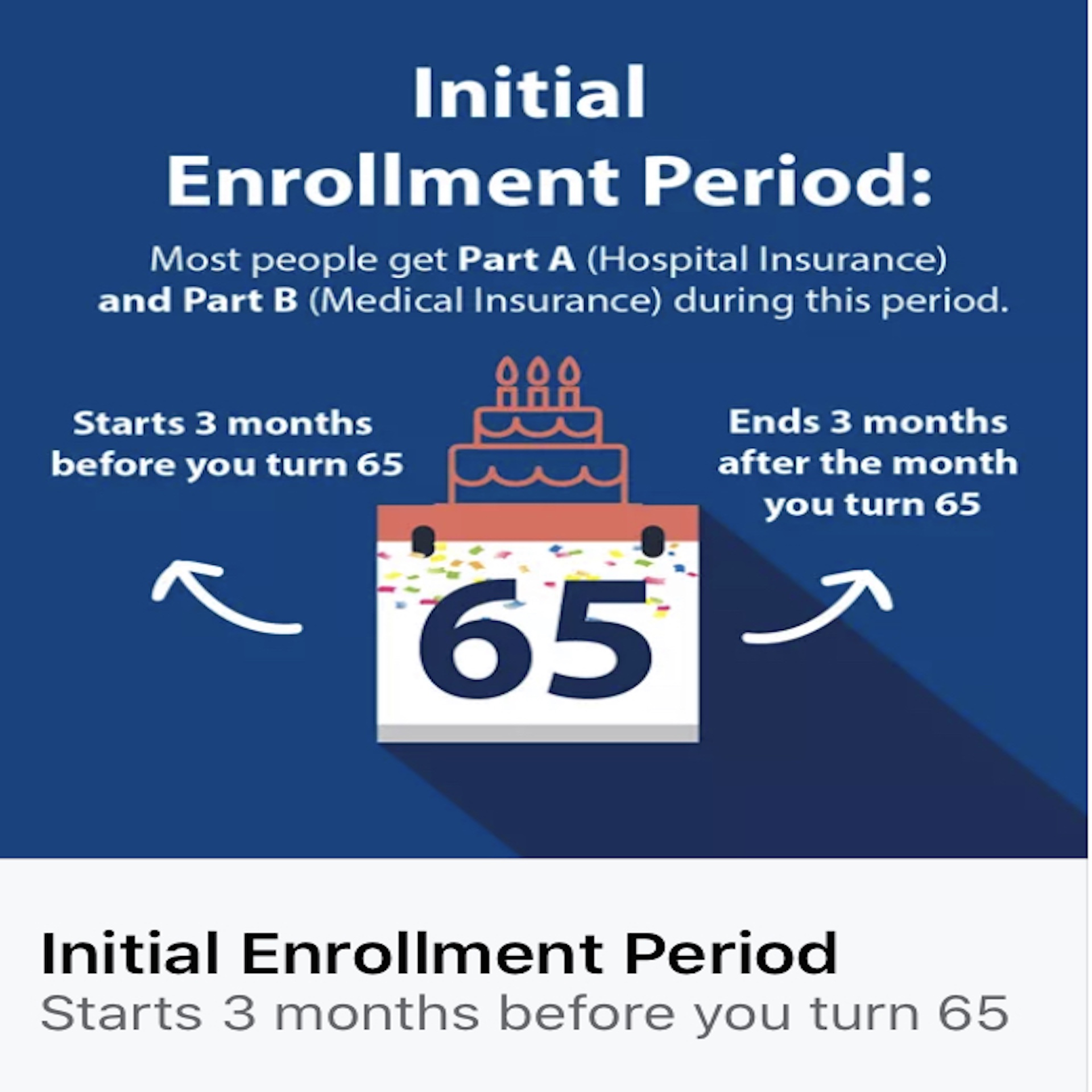

You know that you’re eligible for Medicare if you are 65 years old or older. But did you know there are two different types of plans? You might not think it matters much, but one type may be better for your situation than the other. In this article, we’ll explore the differences between Medigap and mapd plans so that you can decide which is best for you.

How the plans Work

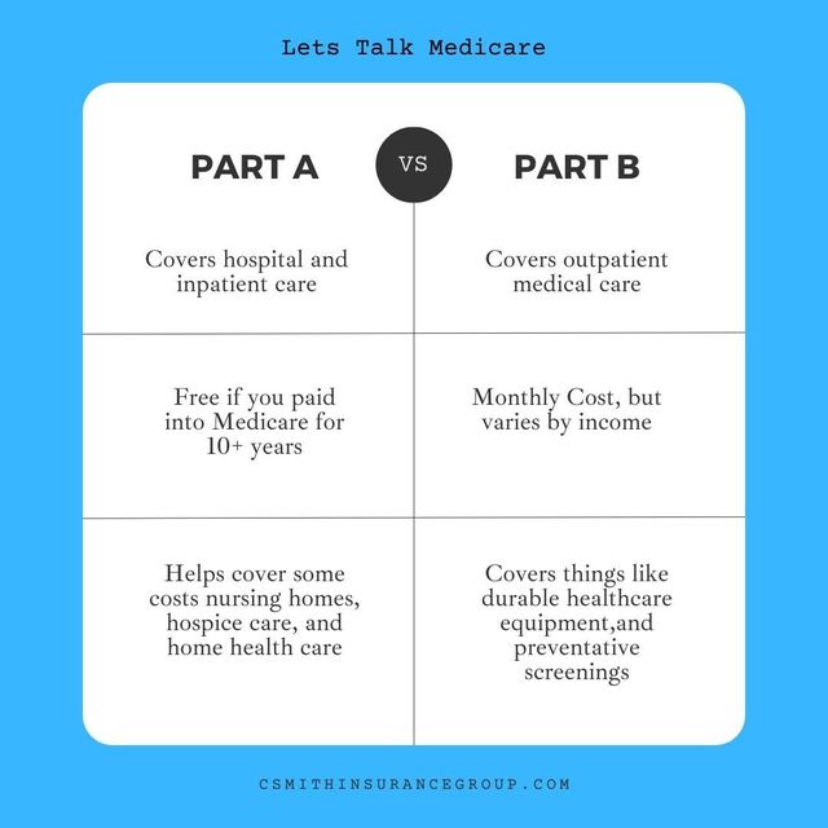

The way Medigap and mapd plans work is that they both help cover the costs of your Medicare-covered expenses. For example, Medigap or mapd might help pay for your coinsurance or provide assistance with deductibles.

Medicare Supplement Plan (Medigap)

There are several Medigap plans available – six basic plans (A through F) and two additional ones (J and N). Some Medigap policies also offer dental coverage, which may be an important feature to consider if you have other Medigap supplemental insurance that doesn’t include it.

Mapd fees vary by plan but generally cost something each month. The monthly premium can range from around $0 to around $100 depending on the plan you select.

Medicare Advantage Plans

Medicare Advantage Plans are newer to the scene, and they work a bit differently. Unlike Medigap or mapd plans, which only cover a certain percentage of your Medicare-covered expenses, Medicaid Advantage plans include all out-of-pocket costs for you as well as Medigap or mapd benefits.

Medicare Advantage plans are generally provided by private insurance companies that contract with Medicare. The advantage here is that Medigap and Medigap supplemental insurance isn’t required to be accepted by providers. In other words, Medigap plan policyholders have more freedom when choosing where they want to receive their care.

The downside is that the Medicare Advantage plan might not be available everywhere you go. This restriction depends on availability within a network, however, so it’s important to check with your provider for details.

Medicare Advantage plans also offer additional benefits such as vision and dental, which Medigap does not cover. If you need these extra services, Medicare Advantage Plan might be a good option for you.

Things to Remember

One important thing to consider is that Medigap and Medigap supplemental insurance can change or become invalid if you join a Medicaid plan after the first 60 days following your initial enrollment in Medicare Part B. Be sure to check with Medigap insurance providers and Medicaid Advantage plans for this restriction.

What Medigap and mapd plans cover is pretty similar, but what Medicare Advantage Plans offer can be quite different. You may want to explore your options if you haven’t already determined which type of plan is right for you. If you decide that Medigap supplement insurance is the way to go, compare Medicare supplement insurance rates, there’s a good chance it will cost less than you think.

For more information Check out What Are Medicare Supplement Plan?