How to Enroll in and Use Medicare: A Comprehensive Guide

1. Introduction

If you’re a U.S. citizen or permanent legal resident over the age of 65, you’re eligible for Medicare coverage. Medicare is a federal health insurance program that covers a variety of medical expenses, including hospitalization, doctor’s visits, and prescription drugs.

In this guide, we’ll walk you through everything you need to know about enrolling in and using Medicare. We’ll cover the different parts of Medicare, how to enroll, what benefits you’re entitled to, and how to use your Medicare card. By the end of this guide, you’ll be ready to take advantage of everything Medicare has to offer!

2. What is Medicare?

Medicare is a federal health insurance program administered by the Centers For Medicare and Medicaid Services (CMS) for individuals over the age of 65. Medicare is split into four parts: Part A, Part B, Part C, and Part D.

Part A is hospital insurance and covers costs for stays in a hospital, as well as nursing care after you leave the hospital. Part B is medical insurance and covers doctors’ visits, preventive care, and medical equipment. Part C is an “all-in-one” plan that combines Parts A and B and is administered by private insurers. Part D is a prescription drug coverage plan.

To qualify for Medicare coverage, you must either be a U.S. citizen or a permanent legal resident who has lived in the United States for at least five years, and you must be at least 65 years old.

3. Who is eligible for Medicare?

In addition to the requirements outlined above, to be eligible for Medicare, you must either have worked in the United States for at least 10 years, have a disability, or have end-stage renal disease (ESRD).

If you or your spouse worked for at least 10 years in the United States but don’t qualify for free Medicare Part A, you may still qualify for a premium-based Part A if you pay a monthly premium. You can check your eligibility for free Part A at the Social Security Administration website.

If you are under the age of 65 and have a disability, you may be eligible for Medicare coverage. To be eligible, you must be entitled to Social Security Disability Insurance (SSDI) for at least 24 months and have a certain kind of disability as determined by the Social Security Administration.

Individuals with end-stage renal disease (ESRD) may also qualify for Medicare. To be eligible, you must be entitled to Social Security Disability Insurance (SSDI) or Railroad Retirement benefits and have been on dialysis for at least three months, or have received a kidney transplant.

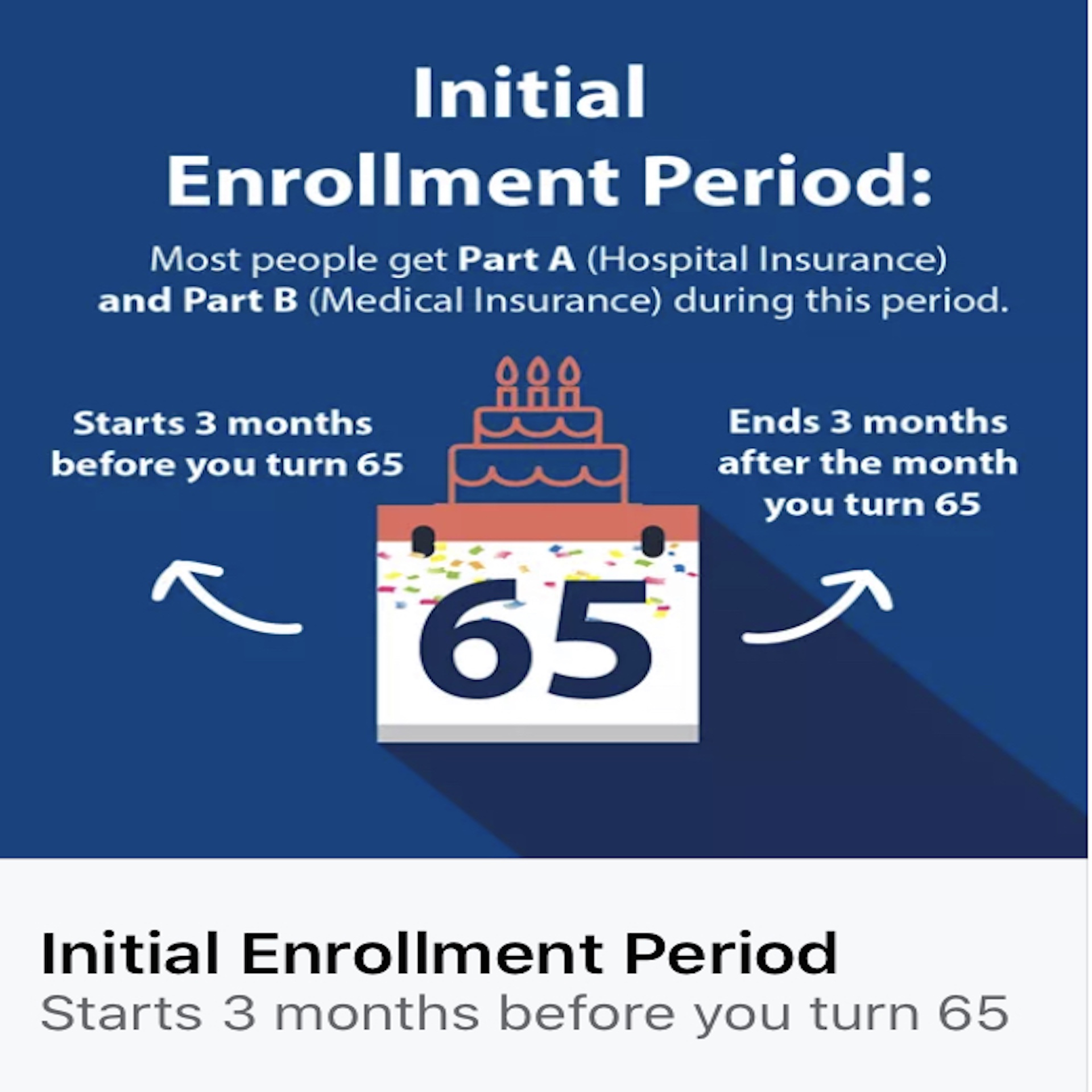

4. When can you enroll in Medicare?

If you’re eligible for Medicare, you can apply for Medicare benefits any time between 3 months before and 3 months after your 65th birthday.

If you’re eligible for free Medicare Part A, you can enroll anytime during the year but may need to wait for the next enrollment period to take effect.

If you’re eligible for premium-based Part A, you must enroll during the period three months before and three months after you turn 65, otherwise, you could be subject to a late-enrollment penalty.

If you’re under the age of 65 and have a disability, you can enroll in Medicare only during certain times of the year.

Individuals with end-stage renal disease may enroll in Medicare as early as three months before their Social Security Disability Insurance (SSDI) or Railroad Retirement benefits begin; however, to avoid penalties, enrollment should take place three months before their dialysis or transplant treatment is initiated.

It is important to note that you might be able to apply for Medicare even if you are not yet eligible for benefits. Doing so will help you understand what Medicare services are available and the cost of those services to you. Your application should be processed within 45 days.

5. How does Medicare work?

Medicare works by providing coverage for specific types of medical services. It is important to understand that not all services are covered by Medicare, so you will likely need additional insurance coverage in order to get the most out of your health care.

The basic Medicare plan is Part A, which covers hospital visits. Part B covers medically necessary doctor services and certain preventive services, plus durable medical equipment, laboratory tests, X-rays, mental health services, and more. Medicare Part C, or Medicare Advantage, is an alternative to the Original Medicare consisting of a private health plan that offers additional coverage. Typically, Medicare Part D provides prescription drug benefits.

You can also purchase a Medicare Supplement plan to help cover some of the costs that Original Medicare does not cover, such as copayments, coinsurance, and deductibles.

When you enroll in Medicare, you will be given a Medicare number that you should use anytime you access services from any health care provider or health insurance plan. This helps ensure that you get the coverage you need. It is important to keep your Medicare number safe.

6. What are the different parts of Medicare?

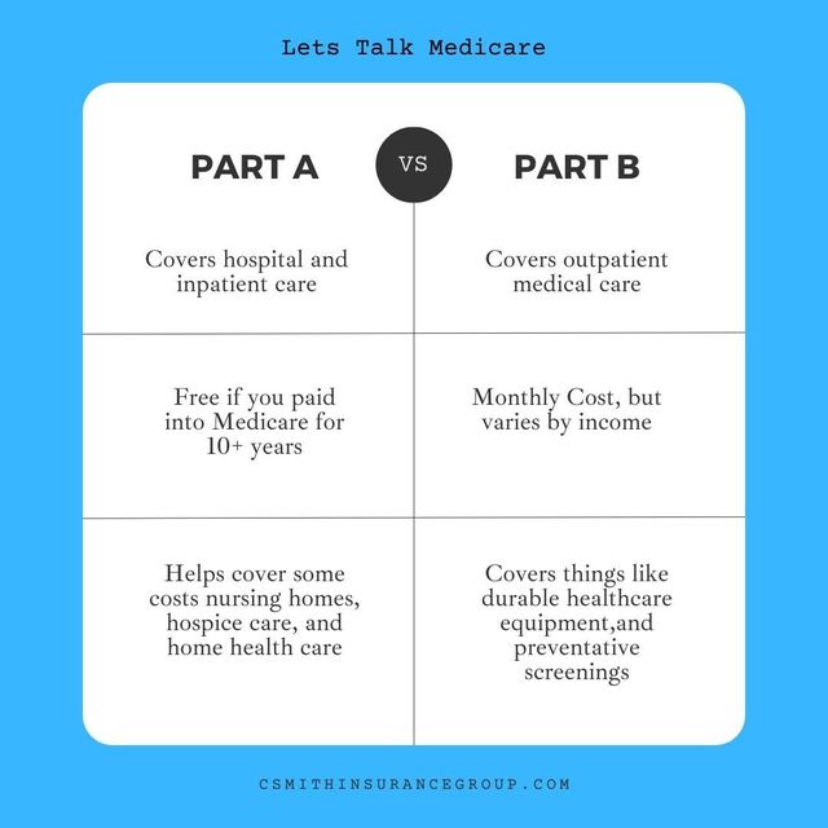

Medicare is made up of four different parts: Part A, Part B, Part C, and Part D.

Part A is the most basic coverage and is considered hospital insurance. It covers inpatient hospital care, skilled nursing facilities, hospice care, and some home health care services.

Part B is medical insurance and covers doctor’s services, physical and occupational therapy, lab tests, preventive services, mental health care, home health care, and other medically-necessary services.

Part C, also known as Medicare Advantage, is an alternative to Original Medicare. It allows you to receive all of your Medicare benefits through a private insurance company.

Part D is prescription drug coverage. It covers both generic and brand-name prescription drugs.

All four parts of Medicare work together to provide you with the care you need. It’s important to understand each part, how much it costs, what services it covers, and how it works with the other parts before making a final decision.

7. How much does Medicare cost?

The cost of Medicare depends on the plan you choose, as well as how much coverage you get from each part.

Part A is usually free for most people who are eligible for Medicare, but there are some exceptions.

For Part B, you’ll pay a premium of $164.90 per month as of 2023. However, if your income is above a certain level, you may have to pay an additional amount.

Part C and Part D involve additional premiums and out-of-pocket costs, depending on the plan you choose. The premium could range from $0 to several hundred dollars per month.

In addition to the premiums, you should also factor in any deductibles, copays, and coinsurance.

8. What are Medigap plans?

Medigap plans, also known as Medicare Supplement plans, are private insurance plans that help cover some of the gaps not covered by Original Medicare, such as copayments, coinsurance, and deductibles. These plans are offered through private insurance companies and are standardized so that coverage and rates are the same no matter which insurer you get your Medigap plan from.

Medigap plans generally have higher premiums than Original Medicare, but they often have much lower out-of-pocket costs. In addition, they can provide coverage for health care costs that Original Medicare does not cover, such as emergency medical care in a foreign country or charges that exceed Medicare-approved amounts.

Most Medigap plans are “guaranteed renewable.” This means you cannot be denied coverage because of your age or health status. However, insurance companies can charge higher premiums for certain people with health conditions or in certain geographical areas.