Limiting charges and excess charges are connected concepts with Medicare, but the link can be confusing. What are they and how do they affect your costs in Medicare?

One of the benefits of being enrolled in Medicare is that most costs are set by the Centers for Medicare & Medicaid Services (CMS) for anyone that uses Medicare. That means there is generally a maximum amount that a doctor who accepts Medicare can charge for a service. This isn’t always the case, though. There are times when you may pay more than this agreed-upon sum. This is when you may come into contact with limiting charges and excess charges under Medicare.

Seeing two different types of charges may be stressful, but once you understand them, they’re not nearly as scary. More importantly, you’ll learn how you can avoid them. But first, let’s explain what they are.

What are Limiting and Excess Charges?

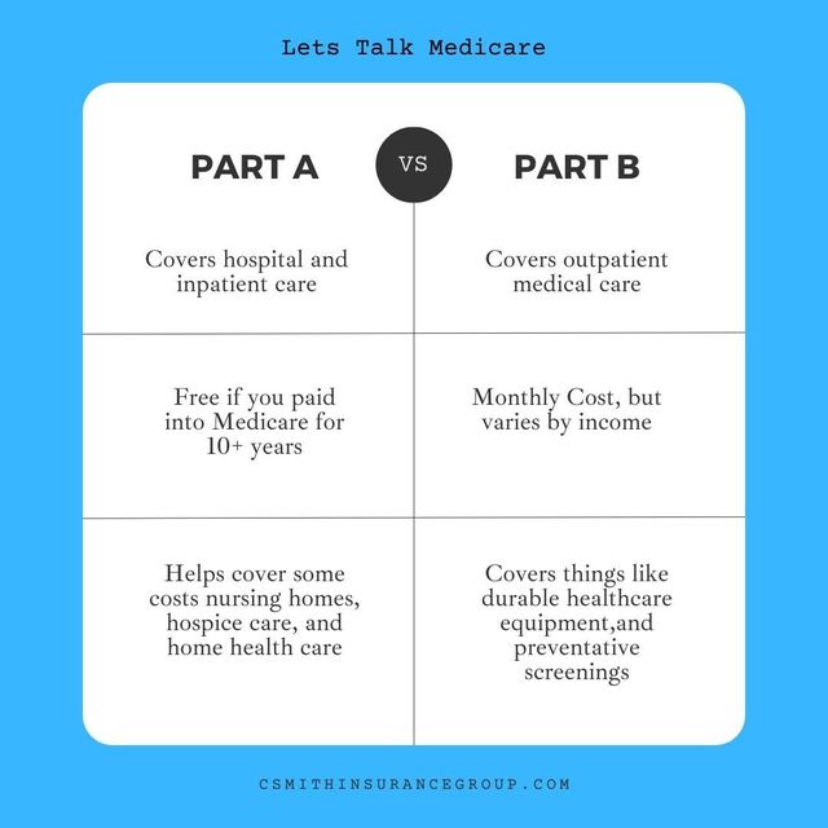

As we stated, the costs of services given that are covered by Medicare are generally controlled by CMS, as long as the doctor accepts Medicare assignment. This simply means that the doctor or health care provider has agreed to be paid by Medicare and to charge patients within the allowed amount. While the majority of doctors accept Medicare assignment (around 93 percent in 2015), not all health care providers do. There are two categories of health care providers who don’t accept Medicare. These are non-participating, which means they don’t have an overall agreement to accept assignment on all Medicare-covered services and opting out, which means they won’t accept assignment on any services. For doctors that opt-out, you’ll be responsible for costs out-of-pocket. Non-participating doctors is where limiting and excess charges can come into play.

Luckily, the health care provider can only charge a maximum of 15 percent more than the Medicare-approved amount.

There are a few ways that a doctor’s non-participation in Medicare assignment influences your costs. The most common of these is that you may have to pay for your costs upfront. Once you pay, you or your doctor may submit a claim for reimbursement with Medicare. The other way is that your doctor can charge you more than the Medicare-approved amount for a service. Luckily, the health care provider can only charge a maximum of 15 percent more than the Medicare-approved amount. These are the limiting and excess charges.

What is the Difference Between the Two?

Okay, so what exactly is the difference between these two? To keep it simple, a limiting charge is the highest amount that can be charged for a service by a non-participating health care provider. Federally, this is set at 15 percent, though some states have it less than that. Limiting charges only apply to certain services. For example, they do not apply to durable medical equipment or to services that Medicare doesn’t normally cover. Limiting charges also would not apply to health care professionals that have opted out of Medicare entirely, though this is only around one percent of all non-pediatric physicians.

Let’s say a certain service costs $20 with Medicare, but your doctor doesn’t accept Medicare assignment. The limiting charge would be capped at $23, or 15 percent over the Medicare-approved amount. The excess charge would then be that $3 over the $20.

This differs slightly, but importantly, from an excess charge. An excess charge is the difference between the Medicare-approved amount for a service and the amount that a health care provider charges. They may sound very, very similar, but the limiting charge is the upper limit that keeps the excess charge from growing beyond a certain point. Let’s say a certain service costs $20 with Medicare, but your doctor doesn’t accept Medicare assignment. The limiting charge would be capped at $23, or 15 percent over the Medicare-approved amount. The excess charge would then be that $3 over the $20.

How Can I Avoid an Excess Charge?

While excess charges are fairly controlled by limiting charges, making them not outrageously expensive, the extra 15 percent charges can begin to add up if you use those services often. This is especially true for specialists that may charge more for their services in general and are less likely to accept Medicare assignment. Luckily, there are ways you can avoid excess charges or at least have them covered.

If you want to stick with Original Medicare, you can rely on a specific Medicare Supplement, Medigap Plan G.

Medicare Advantage Plans

If you’re concerned about excess charges, you have plan options. For a Medicare plan, you could enroll in a Medicare Advantage plan that comes with a network, like an HMO or PPO plan. (These types of plans account for the majority of Medicare Advantage plans.) This ensures that all the health care providers you have access to accept your plan.

Medicare Supplement Plan G (or Plan F)

If you want to stick with Original Medicare, you can rely on a specific Medicare Supplement, Medigap Plan G. Medigap Plan G covers Medicare Plan B excess charges. (If you’re in a high-deductible Plan G, it will cover them once you’ve reached that deductible.) You may be able to enroll in Medigap Plan F, which also covers excess charges if you were eligible for Medicare before 2020. If either of these options interest you, you should check out the Medicareful plan finder tool, which allows you to explore plan options in your area and directly compare them to each other so you can find a plan that fits your needs.

States That Ban Excess Charges

To offer additional protection, some states ban excess charges outright. Currently, it’s only seven states that have banned excess charges, meaning health care providers cannot charge more than the Medicare-approved amount unless they have opted out. These seven states are:

- Connecticut

- Massachusetts

- Minnesota

- Ohio

- Pennsylvania

- Rhode Island

- Vermont

Additionally, New York has a statewide limiting charge below the federal limit. Instead of 15 percent, they’ve set the upper limit to five percent. Between these eight states, you can ensure that your excess charges are tightly controlled or eliminated.

While limiting and excess charges are connected, it’s important to know the difference between the two and how they can influence your costs within Medicare. Effectively, limiting charges limit your spending beyond the Medicare-approved amounts, while excess charges are those costs above the approved amounts. Even beyond the limiting charge, you can control these costs by ensuring your health care providers accept Medicare, and if they don’t, by making sure you have yourself covered for excess charges.

Just like you, your health is one of a kind. What works for one person may not for another, so the information in these articles should not take the place of an expert opinion. Before making significant lifestyle or diet changes, please consult your primary care physician or nutritionist. Your doctor will know your own health best.