Understanding Medicare Enrollment Periods: When Can You Sign Up?

The Importance of Medicare Enrollment Periods

Medicare enrollment periods are crucial timeframes during which eligible individuals can sign up for various parts of Medicare. Understanding these periods is essential to ensure you get the coverage you need without facing penalties or gaps in your healthcare.

Types of Medicare Enrollment Periods

Initial Enrollment Period (IEP)

What is the Initial Enrollment Period?

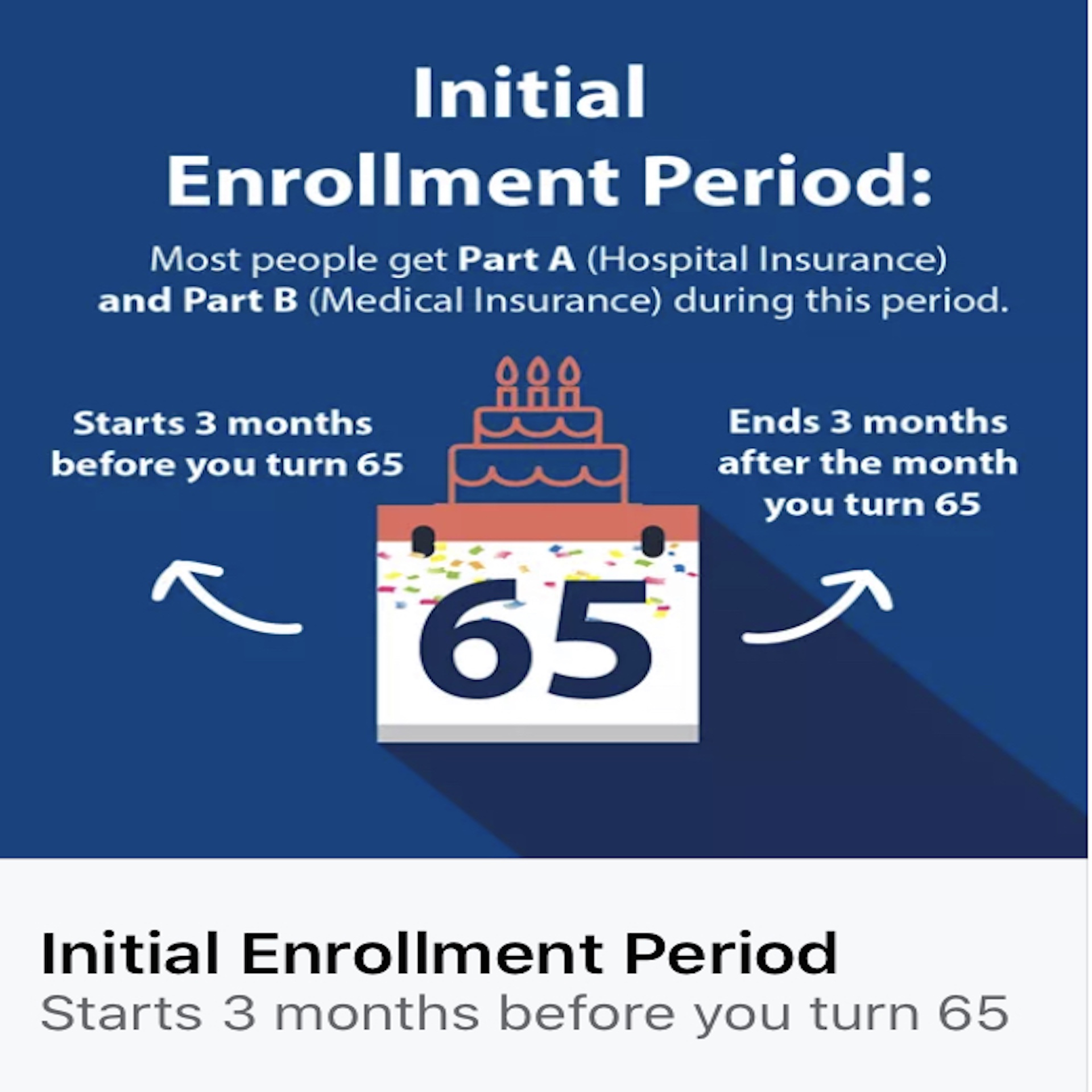

The Initial Enrollment Period is your first opportunity to sign up for Medicare.

When does the IEP occur?

- Begins 3 months before your 65th birthday

- Includes your birth month

- Ends 3 months after your birth month

What can you do during the IEP?

- Enroll in Medicare Part A and Part B

- Sign up for Medicare Advantage (Part C)

- Join a Prescription Drug Plan (Part D)

General Enrollment Period (GEP)

When is the General Enrollment Period?

The GEP runs from January 1 to March 31 each year.

Who is the GEP for?

- Those who missed their IEP

- Individuals not eligible for a Special Enrollment Period

What are the consequences of using the GEP?

- Coverage begins July 1

- May face late enrollment penalties

Annual Enrollment Period (AEP)

When is the Annual Enrollment Period?

The AEP occurs from October 15 to December 7 each year.

What changes can you make during AEP?

- Switch from Original Medicare to Medicare Advantage

- Change from one Medicare Advantage plan to another

- Join, switch, or drop a Medicare Prescription Drug Plan

Medicare Advantage Open Enrollment Period

When is this period?

January 1 to March 31 each year.

What can you do during this time?

- Switch from one Medicare Advantage plan to another

- Drop your Medicare Advantage plan and return to Original Medicare

Special Enrollment Periods (SEPs)

What are Special Enrollment Periods?

SEPs are specific times when you can make changes to your Medicare coverage based on certain life events.

What qualifies for an SEP?

- Moving to a new area

- Losing current coverage

- Changes in your plan that affect your coverage

- Other specific circumstances

How to Prepare for Medicare Enrollment

Steps to Take Before Enrollment

- Review your current health coverage

- Assess your healthcare needs

- Compare Medicare plans in your area

- Understand the costs associated with different plans

Documents You May Need

- Proof of age or disability

- Proof of citizenship or legal residency

- Income information for certain programs

Common Mistakes to Avoid During Enrollment

Missing Enrollment Deadlines

- This can result in coverage gaps

- This may lead to late enrollment penalties

Not Understanding Coverage Options

- Compare Original Medicare vs. Medicare Advantage

- Consider the need for supplemental coverage

Failing to Review Plans Annually

- Plans can change from year to year

- Your health needs may evolve

The Consequences of Late Enrollment

Part A Late Enrollment Penalty

- This applies if you’re not eligible for premium-free Part A

- 10% increase in your monthly premium

Part B Late Enrollment Penalty

- 10% increase for each 12 months you were eligible but not enrolled

- Penalty lasts as long as you have Part B

Part D Late Enrollment Penalty

- 1% of the national base beneficiary premium for each month you delayed enrollment

- Continues as long as you have Part D coverage

Conclusion

Understanding Medicare enrollment periods is crucial for getting the right coverage at the right time. Knowing when you’re eligible to enroll or make changes to your plan can ensure you have the healthcare coverage you need without facing unnecessary penalties or gaps in care.