Top Mistakes to Avoid When Choosing a Medicare Plan at Age 65

Choosing a Medicare Plan at Age 65 is a key decision that can impact your finances and health care for years to come. Unfortunately, many people make mistakes that could be easily avoided with a bit of knowledge. Missing your enrollment period, not understanding the different parts of Medicare, or choosing the wrong plan can lead to higher costs and less coverage. This post covers the top mistakes to avoid, helping you make an informed decision and ensuring you get the coverage you need without unnecessary stress or expense.

Understanding the Basics of Medicare

When turning 65, understanding Medicare is crucial to ensure you make the best choices for your health and finances. Knowing the different parts of Medicare, along with eligibility and enrollment periods, can prevent you from making costly mistakes.

Medicare Parts Explained

Choosing a Medicare Plan at Age 65. Medicare is divided into four main parts, each covering different aspects of healthcare:

- Medicare Part A: Think of Part A as your hospital insurance. It covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. Most people don’t pay a premium for Part A if they or their spouse paid Medicare taxes for a certain period (at least 10 years).

- Medicare Part B: This is your medical insurance. Part B covers outpatient care, doctor services, preventive services, and some home health visits. Unlike Part A, everyone pays a premium for Part B, and it’s essential to enroll on time to avoid penalties.

- Medicare Part C: Also known as Medicare Advantage, Part C plans are offered by private companies approved by Medicare. These plans combine Part A and Part B coverage and often include Part D (prescription drug coverage) as well. They may offer extra benefits like vision, hearing, and dental.

- Medicare Part D: This part is all about prescription drugs. Private insurance companies offer part D plans and help cover the cost of prescription medications. Like Part B, enrolling late in Part D can lead to penalties.

Eligibility and Enrollment Periods

To make sure you don’t face late enrollment penalties, it’s important to know when and how to enroll in Medicare:

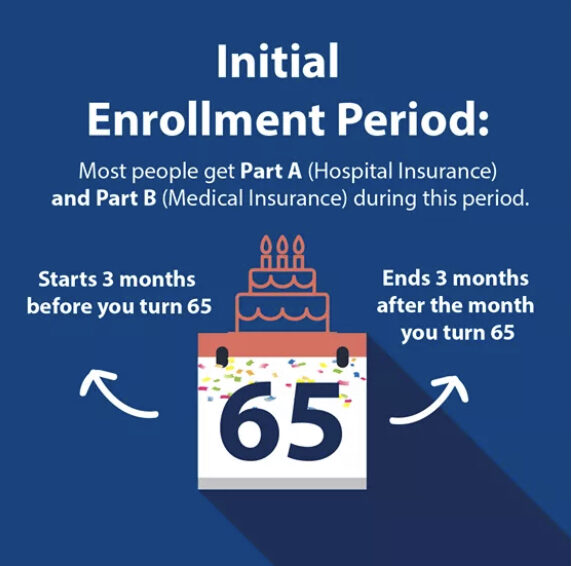

- Initial Enrollment Period (IEP): You first become eligible to sign up for Medicare three months before you turn 65, including the month you turn 65, and ends three months after.

- General Enrollment Period (GEP): If you miss your IEP, you can enroll in Medicare from January 1 to March 31 each year. Coverage starts July 1, but you may have to pay a late enrollment penalty.

- Special Enrollment Period (SEP): If you or your spouse are still working and have health coverage through the employer, you might qualify for a SEP. It allows you to enroll in Medicare without penalties once the employment or coverage ends.

Understanding these basics ensures you won’t face unexpected penalties and helps you choose the right plan that suits your health needs.