We talk a lot about what Medicare costs to use, but not how the benefits are financed. Here’s how Medicare is funded, and how we each help ensure enrollees receive affordable health care.

There are 61 million people in the United States that are enrolled in Medicare and rely on its coverage to afford vital health care. While there are costs associated with Medicare, like premiums and copays, there’s still a lot that Medicare covers that isn’t paid for by those costs. In fact, in 2020, 99 percent of Medicare Part A beneficiaries received their coverage premium-free. With the substantial amount that Medicare covers, how does the program stay solvent?

While it’s easy to say “taxes” and move on, that doesn’t tell the whole story. Understanding what taxes and trust funds pay for the health care of millions of beneficiaries — many of them with the greatest need for the care and coverage — offers clarity for those funding measures and shows just how affordable these programs are when we all chip in.

The Medicare Trust Funds

The way Medicare is funded is, in a large part, through taxes. Most of us know that much, but different taxes help pay for different parts of Medicare via trust funds. The United States Treasury holds two trust funds that directly fund the parts of Medicare. The taxes that have been placed in the trust funds can only be used to run and support Medicare. Not only do they allow Medicare to run, the trust funds are authorized to help cover administrative costs like collecting Medicare taxes and combatting Medicare abuse and fraud

Hospital Insurance (HI) Trust Fund

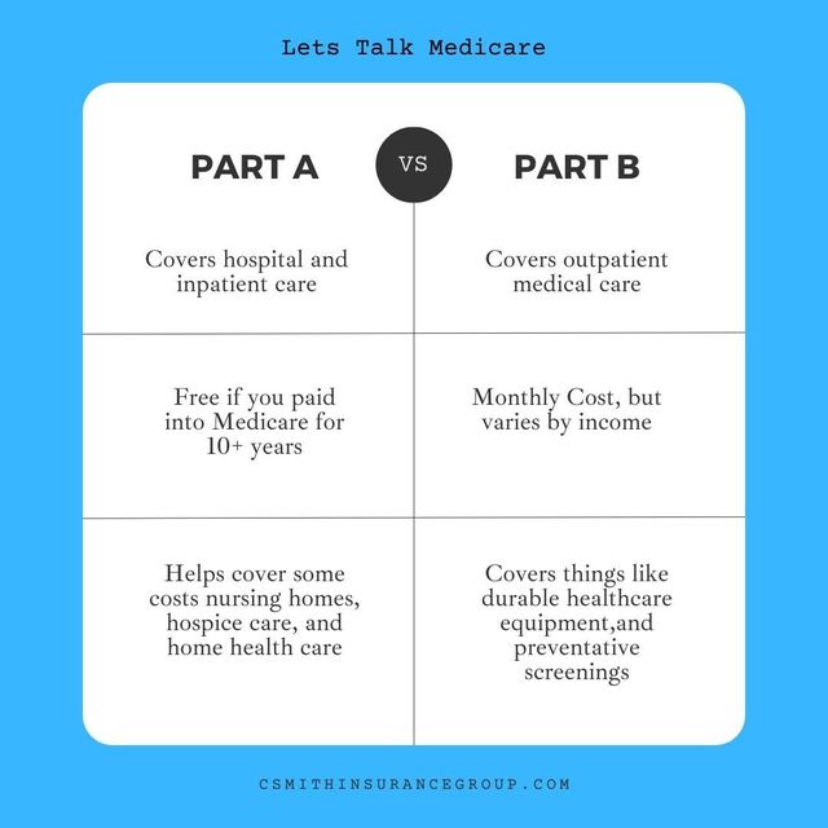

The Hospital Insurance (HI) Trust Fund is designed to fund the benefits covered under Medicare Part A. This mostly includes inpatient services, like stays at hospitals or skilled nursing facilities and the care that you receive there. In some circumstances, Part A will also cover things like home health care and hospice care, and many of the tangential parts that go along with inpatient care. This could include a semi-private room, prescription drugs taken as part of inpatient treatment, and meals.

Supplemental Medical Insurance (SMI) Trust Fund

The second trust fund, the Supplemental Medical Insurance (SMI) trust fund, covers more services and care than the HI trust fund. The SMI trust fund covers the services offered by both Medicare Part B and Medicare Part D. Medicare Part B covers many of your medical needs, including doctor visits, preventative care, and durable medical equipment. Medicare Part D covers prescription drugs. Together, they cover a wide range of health care needs that beneficiaries may have.

How Does the HI Trust Fund Receive Funding?

The HI Trust Fund receives the grand majority of its funding through payroll taxes. For example, in 2018, the trust fund received 88 percent of its money through this tax. For the portion to be that large, it must be a huge tax on your payroll, right? Actually, unless you’re considered a high earner, you’ll only pay 1.45 percent toward the Federal Insurance Contributions Act (FICA) tax, while your employer pays another 1.45 percent. As mentioned earlier, high income persons pay a little more. If you exceed the threshold for the Additional Medicare Tax, you’ll owe an additional .9 percent. The thresholds for this tax are:

Beyond the FICA tax, Medicare Part A and the HI Trust Fund are funded by taxes on the benefits of Social Security (making up about eight percent of the funding in 2018). A small percentage of the money also comes from interest on the trust fund’s various investments that helps swell the available cash. Finally, the HI trust fund receives a small boost from Medicare Part A premiums. This is a very small proportion since, as noted earlier, almost all Medicare Part A beneficiaries qualify to receive the coverage premium-free.

How Does the SMI Trust Fund Receive Funding?

The SMI trust fund differs from the HI trust fund in that it doesn’t receive funding from payroll tax. Instead, the largest portion of the funding comes from general revenue allowances. For example, it accounted for 72 percent of the funding for Medicare Part C and 71 percent for Medicare Part D in 2018. General revenue includes funds that have been authorized for use as part of the overall budget by Congress.

The other major source of funding for the SMI trust fund is premiums, which both Part B and D have. They make a surprisingly low percentage, accounting for 26 percent and 17 percent of Part B and D funding, respectively, in 2018. The rest of the funding is made up of smaller sources like interest from trust fund investments.

What About Medicare Advantage Plans?

You may be wondering about Medicare Part C, or Medicare Advantage as it’s sometimes called. While this type of plan is offered by private companies, they still receive funding from the government as part of the Medicare program. As such, they still are at least partially funded by both the HI and SMI trust funds, though costs that go above this are picked up by either the plan or the beneficiary, in the form of premiums and out-of-pocket costs.

They say nothing in life is free, and this goes for affordable health care coverage, too. But when you weigh the good that Medicare coverage offers, like ensuring beneficiaries can get critical health care when they need it, along with how little we each have to chip in to make a big difference, the value of this program may become clearer. No wonder why Medicare programs have remained so popular over 50 years after their creation.